Tenable Holdings (TENB)·Q4 2025 Earnings Summary

Tenable Crushes Q4 as Platform Strategy Accelerates, Shares Jump 6%

February 4, 2026 · by Fintool AI Agent

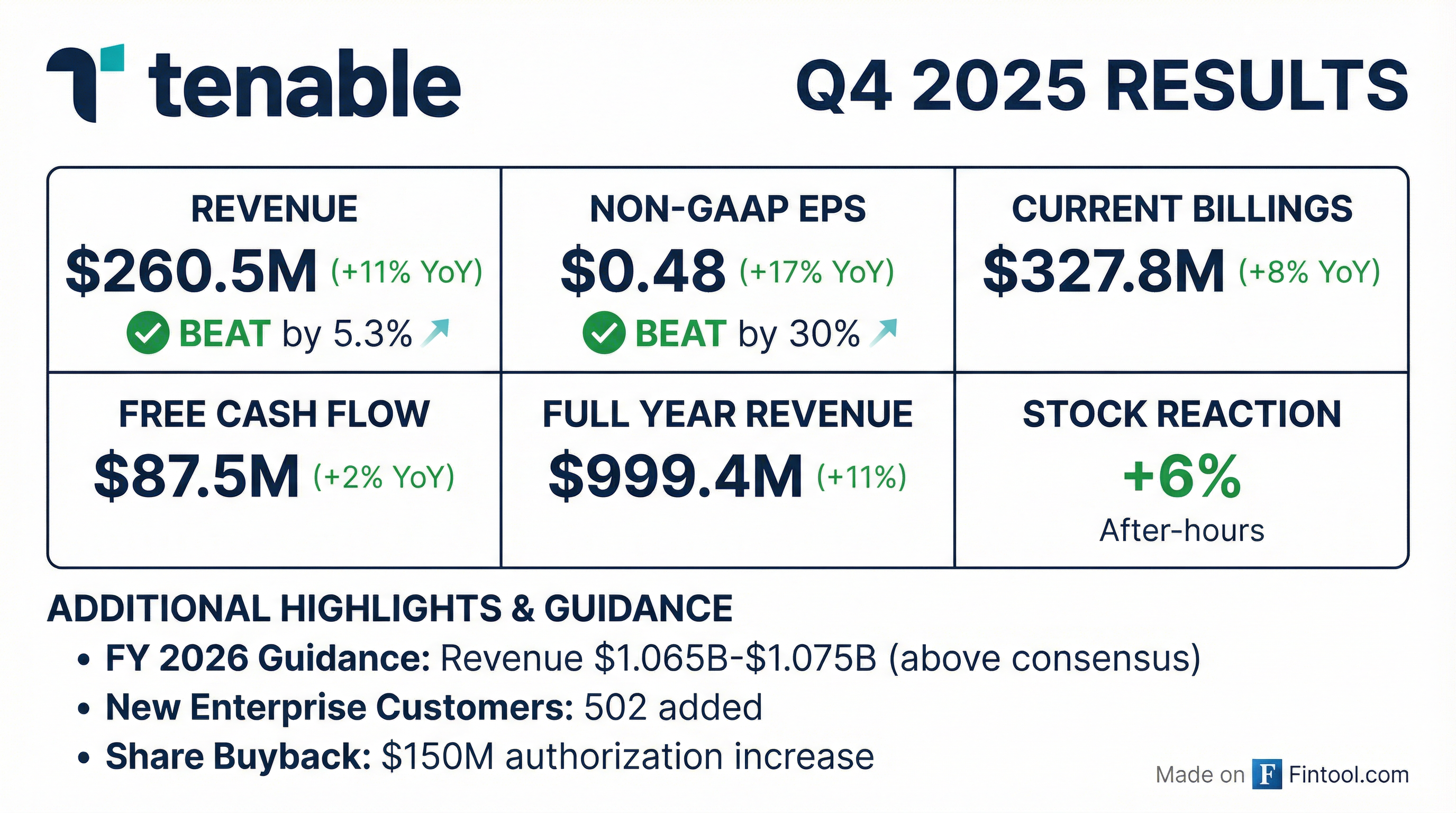

Tenable Holdings (NASDAQ: TENB) delivered a strong finish to FY25, beating all guided metrics and providing FY26 guidance above street expectations. The cybersecurity company reported Q4 revenue of $260.5M (+11% YoY) and Non-GAAP EPS of $0.48 (+17% YoY), significantly ahead of consensus estimates.

Shares jumped approximately 6% in after-hours trading to $21.00, reversing the day's 1.6% decline.

Did Tenable Beat Earnings?

Both revenue and earnings exceeded expectations by wide margins:

This marks Tenable's 8th consecutive quarter of beating revenue estimates. The EPS beat was particularly strong, driven by better-than-expected operating leverage and continued cost discipline.

Full year 2025 also exceeded all guided metrics:

Tenable One Platform Momentum

Tenable One reached all-time highs for platform adoption:

"46% of our total new sales came from the platform. Customers clearly want a platform." — Co-CEO Mark Thurmond

CFO Matt Brown emphasized the platform economics: "Customers moving to the platform to do full exposure management can see as much as 80% uplift... these are the customers that we want—they're churning less, they're expanding more, the deals are larger in size."

With roughly two-thirds of Tenable's business not yet on the platform, this represents a significant embedded growth opportunity.

First 7-Figure AI Exposure Deal

AI security emerged as a significant growth driver:

"We closed our first seven-figure deal driven by AI exposure in the quarter. A major telecommunications provider selected Tenable One to gain visibility into how AI was being deployed and used throughout the organization." — Co-CEO Mark Thurmond

Management highlighted that AI is now coming up in "every single conversation" with CISOs. Key AI use cases customers are adopting:

- Shadow AI discovery across the entire enterprise

- AI attack surface visibility including public services being used

- AI workload protection from misconfigurations and non-human identities

- Governance controls for AI deployment and usage

Co-CEO Steve Vintz emphasized: "AI is a massive opportunity for us... It makes us more relevant. It makes us more important, and more importantly, it makes exposure management more critical for our customers."

What Did Management Guide?

FY26 guidance came in above street expectations:

Q1 2026 guidance:

- Revenue: $257M - $260M (+8% YoY at midpoint)

- Non-GAAP EPS: $0.39 - $0.42 (+12.5% YoY at midpoint)

Key guidance changes:

- CCB guidance discontinued due to billing duration distortion, though management expects FY26 CCB in-line with consensus

- Net dollar expansion rate expected to stabilize at 105% in H1 2026, then potentially inflect higher

- Restructuring charges of ~$5M expected in H1 2026

Customer Wins Highlight Platform Strategy

Three major wins demonstrate the breadth of Tenable One adoption:

1. Global Enterprise Consolidation A large global enterprise significantly expanded its Tenable One deployment after consolidating multiple VM technologies, choosing Tenable for deeper visibility, reduced operational overhead, and third-party risk management.

2. Telecommunications AI Exposure (7-Figure Deal) Major telco selected Tenable One to gain visibility into AI deployment across the organization, including which agents are being used, what data is being shared, and how AI activity creates exposure paths.

3. Higher Education Consortium (20+ Campuses) Large higher education consortium selected Tenable for multi-phase exposure management initiative spanning more than 20 campuses as part of a statewide cybersecurity modernization effort. Customer consolidated on Tenable and eliminated competitive solutions.

Capital Allocation Update

Aggressive share repurchase program expanded:

Management explicitly stated: "We believe that our current share price trades at a discount relative to our true value, and that utilizing our strong balance sheet and cash flow generation to more aggressively repurchase shares is an effective use of capital."

Cash position:

- Cash, cash equivalents and short-term investments: $402.2M

- FY25 Unlevered Free Cash Flow: $277.0M (27.7% of revenue)

How Did the Stock React?

Tenable shares traded down 1.6% during regular hours to close at $19.72, before rallying approximately 6% in after-hours trading to $21.00 on the earnings beat and above-consensus guidance.

Context on valuation:

- Current price: $19.72 (regular close) / $21.00 (after-hours)

- 52-week high: $43.68

- 52-week low: $19.55 (touched today)

- Market cap: ~$2.4B

The stock has declined significantly from its 52-week highs despite consistent execution, suggesting the market may have been overly cautious heading into this print. The strong results and guidance could catalyze a reassessment.

Q&A Highlights

On Tenable One module adoption (Saket Kalia, Barclays): Co-CEO Steve Vintz: "Most customers who are using the platform are using us for traditional VM, but plus web app, plus cloud security, which continues to grow at a very nice rate. And then more recently, securing the AI attack surface... Going forward, there'll be less emphasis on individual modules and the emphasis is really selling the platform."

On pricing environment (Shaul Eyal, TD Cowen): Co-CEO Mark Thurmond: "We're not seeing any pricing pressure. When you're selling Tenable One, it's a consolidation play... you're able to get very, very good pricing. We're not seeing any pricing pressure with new logo or with our installed base."

On professional services strength (Joseph Gallo, Jefferies): Thurmond explained the uptick: "As we now are deploying a platform at scale, we're able to go in there with our professional services organization and help them on this exposure management journey. When it was just core-based VM, there wasn't this massive demand for professional services."

On federal assumptions (Rudy Kessinger, D.A. Davidson): CFO Matt Brown: "Expectations for federal will perform more or less in line with the rest of the business. We're not expecting outsized growth and we're not expecting any particular headwinds."

On AI budget allocation (Abhishek Murli, Morgan Stanley): Thurmond: "When you look at RFPs and opportunities right now, AI is being added to exposure management... For significant budget dollars. You're seeing that budget from an AI perspective be added into exposure management."

Revenue and Margin Trends

Revenue has shown consistent double-digit growth:

Profitability continues to improve:

Management has expanded non-GAAP operating margin by 680 basis points since end of 2023, demonstrating strong operational leverage.

What Changed From Last Quarter?

Key operational highlights:

- New CTO appointed: Vlad Korsunsky, former Microsoft cloud and AI security leader, joined to advance AI strategy and agentic capabilities

- 502 new enterprise platform customers added in Q4 — best quarter in 2 years

- Net dollar expansion rate: 106% — ahead of 105% expectations

Industry recognition:

- Named a Leader in 2025 Gartner Magic Quadrant for Exposure Assessment Platforms

- Named company to beat in 2025 Gartner AI Vendor Race for AI-powered exposure assessment

- Named Customers' Choice (alongside Wiz) in Gartner Peer Insights for CNAPP

Restructuring initiative: At end of Q4, Tenable began realigning departments, stripping out redundant roles and reinvesting into Tenable One platform and AI security innovation. Restructuring charges: $3.1M in Q4 2025, ~$5M more in H1 2026.

What to Watch Going Forward

- Tenable One platform adoption: Now at 46% of new business with 80% ASP uplift — watch for continued mix shift

- AI exposure monetization: First 7-figure deal closed; pipeline building as AI shows up in every CISO conversation

- Net dollar expansion stabilization: Expected to hold at 105% in H1, then potentially inflect higher

- Billings duration normalization: Annual installment billing shift creating near-term CCB distortion

- New CTO impact: Vlad Korsunsky's Microsoft AI experience driving agentic and remediation roadmap

- Federal stability: Q4 federal was strong; 2026 expected in-line with overall business

Related Links: